Moldova’s fuel imports near 737K tons; Diesel dominates

Moldova imported over 737 thousand tons of petroleum products in the first nine months of 2025, a volume almost entirely consumed, according to a report released by the National Agency for Energy Regulation (ANRE).

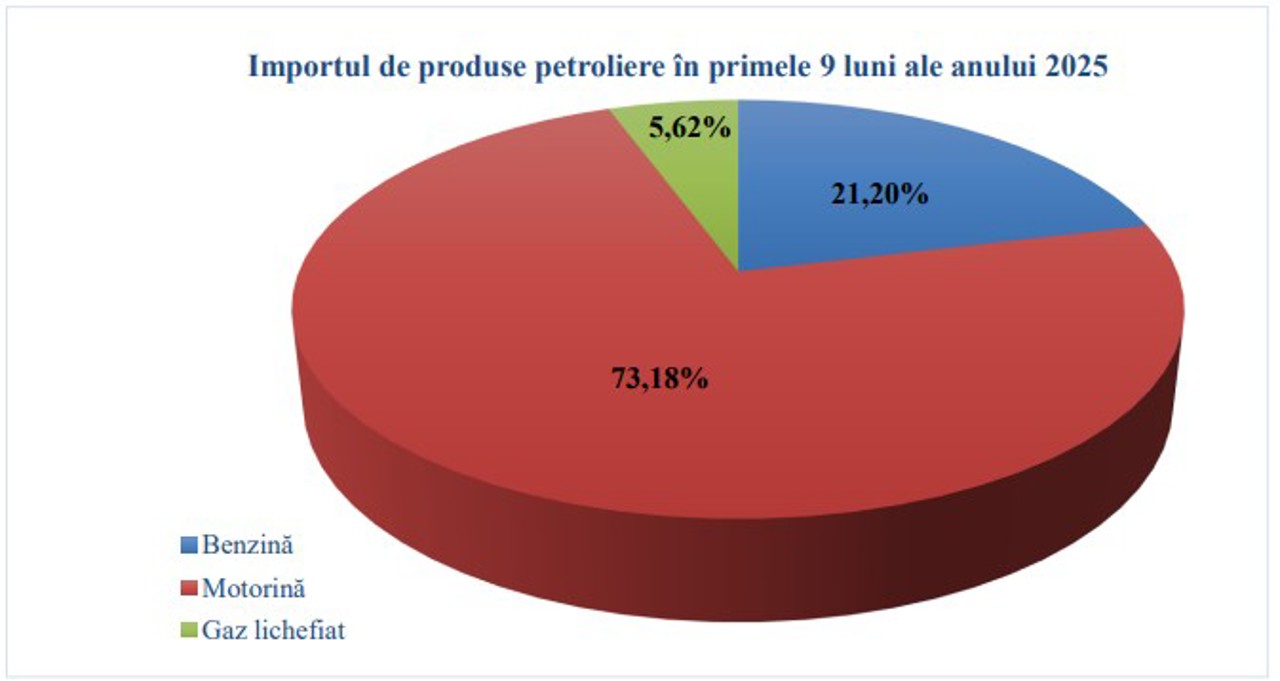

Diesel fuel remains the dominant product, accounting for over 73% of all imports, while Romania continues to be the primary supplier for gasoline, diesel, and liquefied petroleum gas (LPG).

Pump prices hit their annual low in May and, despite subsequent stabilization, remained below January levels in September. Concurrently, both wholesale and retail sales registered increases compared to the same period in 2024.

Detailed Report: Imports, Consumption, and Key Suppliers

ANRE notes that, between January and September 2025, the Republic of Moldova imported 737,583 tons of petroleum products. Diesel fuel made up the largest share, with 539,770 tons, constituting over 73% of the total.

Gasoline imports totaled 156,390 tons, and liquefied petroleum gas (LPG) amounted to 41,422 tons.

Domestic consumption, at 735,920 tons, was very close to the total import volume.

According to the report, inventories in storage facilities and at filling stations were sufficient, at the end of September, to cover "25 days for gasoline, 16 days for diesel, and 27 days for LPG."

Romania – The Main Fuel Supplier for Moldova

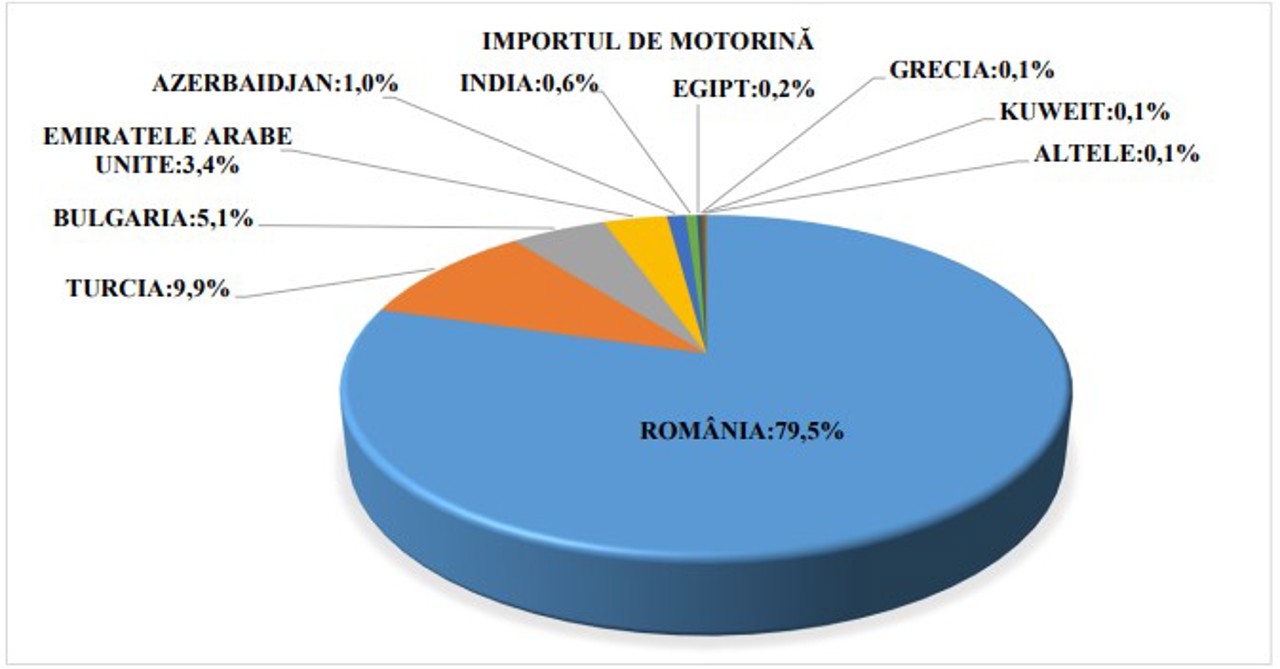

ANRE data further indicates that Romania remains the dominant supplier for most petroleum products.

"The main supplier of gasoline for the Republic of Moldova was Romania, with a share of 99.2%," the report states.

For diesel fuel, Romania supplied 79.5% of the imported quantity, followed by Turkey, Bulgaria, and the United Arab Emirates.

Romania's share in the supply of liquefied petroleum gas was 70.7%.

Market Trends: Standard Diesel Dominates Sales

Standard diesel continues to be the most sought-after petroleum product on the domestic market. The report shows that it held "a share of 83.8% of the total volume of sales on the wholesale market and 55.2% in the retail segment."

Compared to the similar period last year, wholesale sales of standard diesel increased by over 66,000 tons, and sales at the pump grew by over 16 million liters.

Overall, the wholesale trade increased by 56,710 tons (a 9.6% rise compared to the same period in 2024), and retail sales grew by 36 million liters (a 5.4% increase).

Price Evolution: Drop in Q1/Q2, Stabilization in Q3

The evolution of pump prices during the first nine months was influenced by significant drops in the first half of the year.

In May, the period's minimum prices were registered: A95 gasoline dropped to 22.42 lei/liter, A98 gasoline to 26.90 lei/liter, and standard diesel to 18.23 lei/liter.

For LPG, the minimum was recorded in September at 12.51 lei/liter, which was 1.32 lei/liter below the January level.

The report mentions that, "in September, prices for both gasoline and diesel remained below the level recorded at the beginning of the year," following a phase of decrease and subsequent stabilization.

Evolution of Import Prices

Average import prices followed a similar trajectory. For gasoline, the minimum level was in May at $737.3/ton, while the maximum was in February at $799.4/ton.

Diesel fuel recorded a price minimum of $681.7/ton in May and peaked at $793.7/ton in July.

LPG registered its lowest import price in June at $564/ton.

Infrastructure: Over 600 Stations and 208 Active Licenses

Regarding infrastructure, ANRE reports the existence of 601 certified filling stations, of which 448 are mixed stations.

In the first nine months of the year, the institution issued 25 new licenses, extended five, withdrew nine, and made 43 amendments.

In total, there are 208 active licenses on the petroleum products market.

Translation by Iurie Tataru