Moldova strengthens fiscal discipline with targeted inspections across high-risk sectors

The State Tax Service (STS) has announced an intensification of operational tax audits throughout February 2026. This initiative aims to prevent the misuse of cash register equipment and combat broader fiscal legislation violations.

The unannounced, on-site inspections will target sectors identified with a high risk of non-compliance. These include retail trade, florists, precious metal dealers, beauty services, transportation, and the HoReCa industry.

Inspectors are prioritizing the verification of cash receipts, the accurate reporting of all income, and the legal provenance of all goods held for sale. These measures are designed to maintain a level playing field for all compliant businesses.

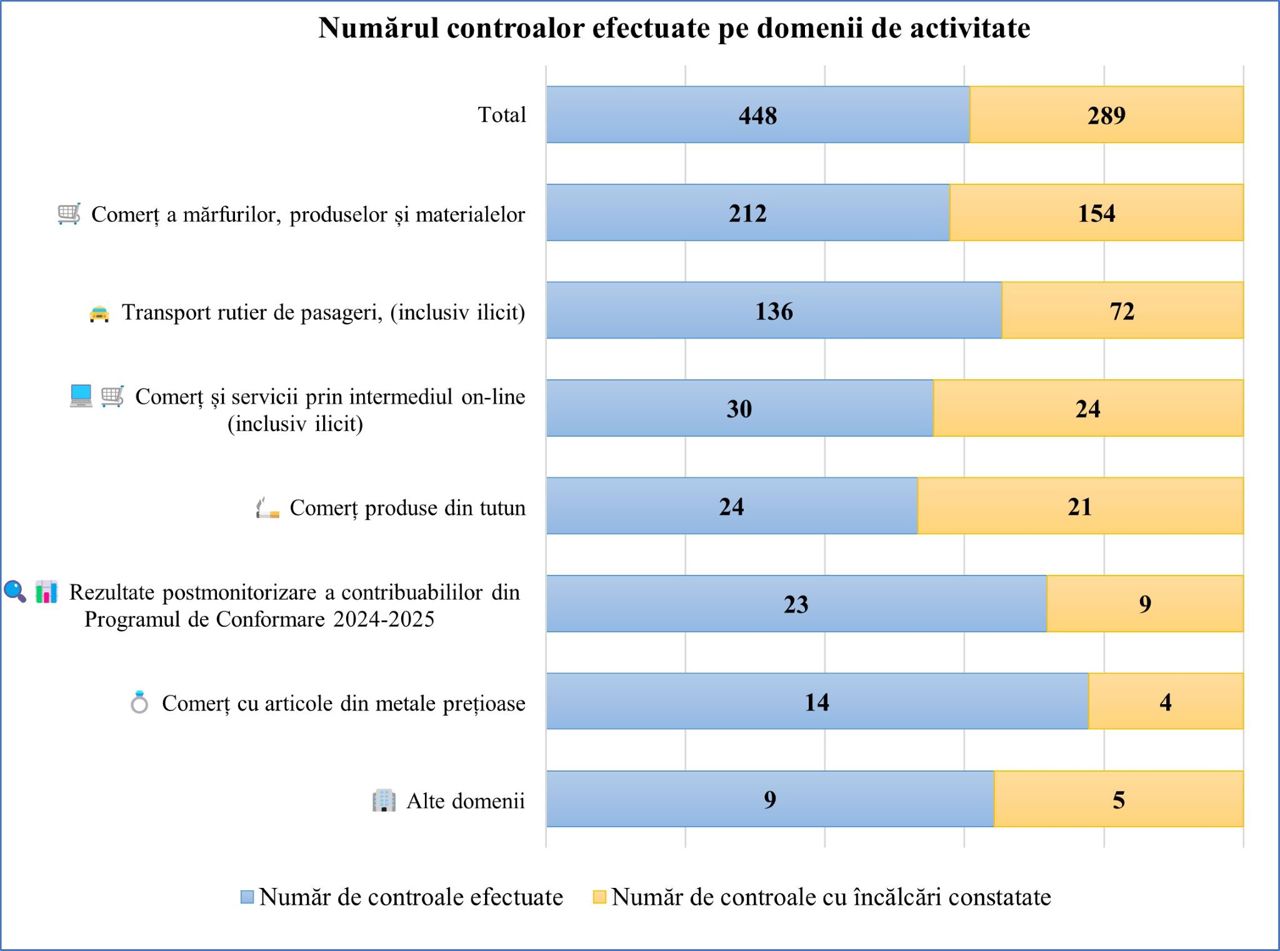

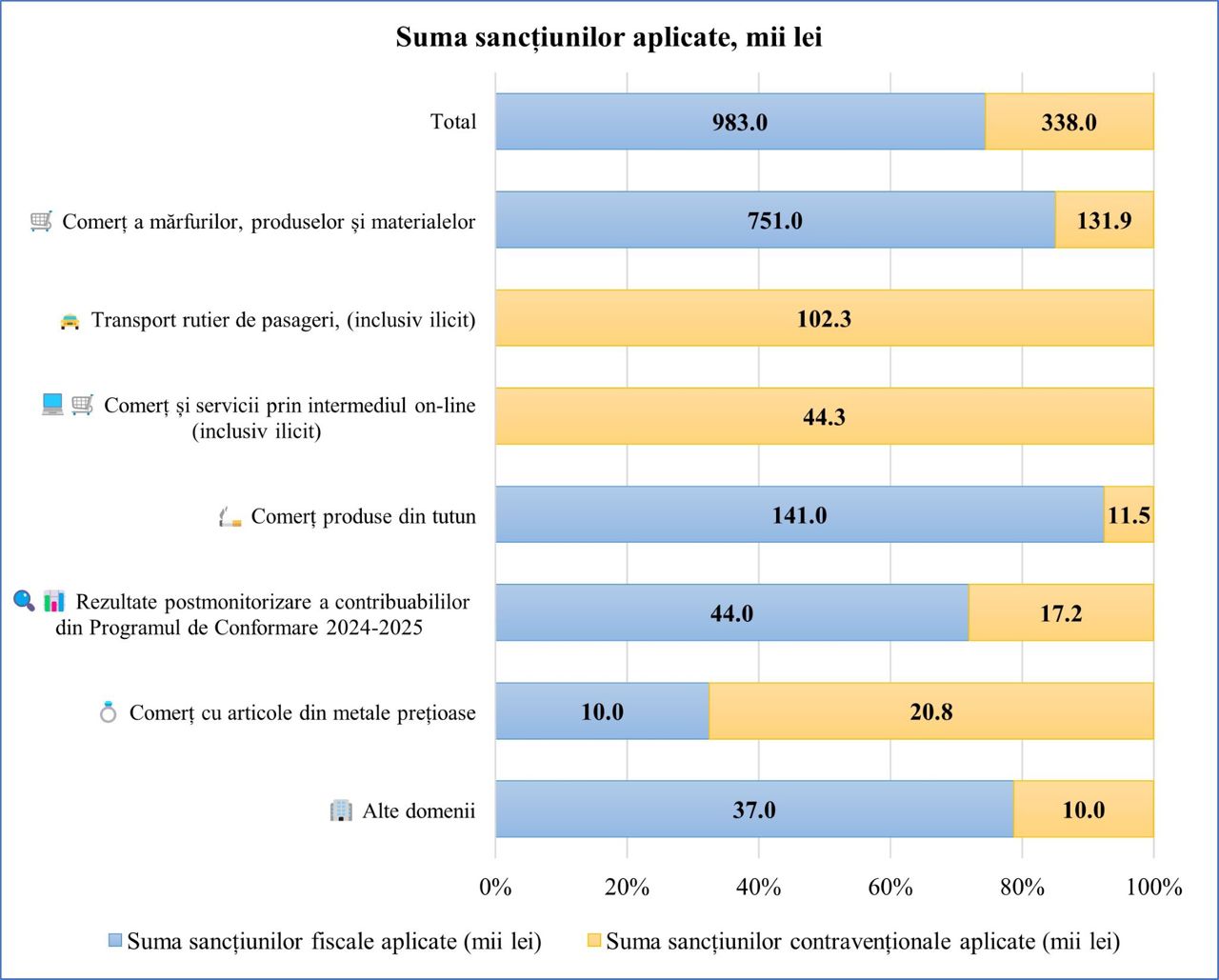

Preliminary data from January 2026 shows that out of 448 operational audits, 289 violations were identified. This resulted in approximately €50,153 (983,000 MDL) in tax sanctions and an additional €17,245 (338,000 MDL) in administrative fines.

The STS emphasizes that these actions are crucial for discouraging illegal practices that drain the public budget. By ensuring fair competition, the authority aims to protect businesses that operate transparently.

Economic agents are urged to comply with all legal requirements. The tax authority reminds taxpayers that properly declared taxes directly fund vital public services, including healthcare, education, pensions, and modern infrastructure.

Translation by Iurie Tataru